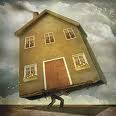

A recent article from The Niche Report indicates that during the vertiginous days of the American housing bubble, many borrowers who accepted mortgages on a whim found out the perils of their haphazard actions the hard way. The initial wave of mortgage delinquencies in the United States was felt in 2007, and it mostly involved risky subprime loans. Five years later, a group  of homeowners are having a hard time making their monthly mortgage payments -on residential loans insured by the U.S. Federal Housing Administration (FHA).

of homeowners are having a hard time making their monthly mortgage payments -on residential loans insured by the U.S. Federal Housing Administration (FHA).

According to the first quarter report issued by the U.S. Office of the Comptroller of the Currency, the number of FHA-backed loans that were delinquent by more than 90 days increased by 27 percent from January 1 to March 31. This is clearly a cause for concern given the fact that as a government institution, taxpayers have a significant stake in FHA. Other reports indicate that the agency’s financials are far from solid; further deterioration and losses could even require a bailout from the federal government.

Mortgages backed by the FHA have always been a viable option in the American residential lending industry, but there was a time when major lenders and originators shunned FHA mortgages in favor of riskier and more profitable debt instruments. After the bursting of the housing bubble and the subsequent subprime mortgage meltdown, lenders significantly tightened down on their credit and lending guidelines and also looked for the safety net of government guarantees. Fannie Mae and Freddie Mac are two government-sponsored investors who provide guarantees to mortgage lenders; FHA provides similar guarantees that stimulate lending to some applicants who do not meet today’s stringent requirements.

FHA-backed mortgages are far from being a replacement for subprime home loans. There is a clear need for FHA loans these days, and while their lending standards may be lower in comparison to Fannie and Freddie mortgages, the agency has increased requirements since 2009. Not all applicants these days will qualify for FHA loans, and over the last couple of years the agency has increased its minimum credit scores, down payments, mortgage insurance premiums, and underwriting.

This rise in FHA mortgage delinquencies comes at a time when the American economy seems stuck in neutral. Job growth is still stagnant and while median incomes have risen to a certain extent, not everyone enjoys full time employment or job security. The FHA has been looking for ways to increase its reserves and avoid a bailout, but the agency might not survive a second recession

Follow

Follow