We currently seeing amazing mortgage interest rates and those who can refinance, often ask , “What is better a 30 year mortgage or a 15 year mortgage?”. Now, the answer shall always consider your needs and goals, but a 30 -year mortgage brings more benefits rather than a a 15-year mortgage. A recent article by the financial advisor, Ric Edelman, gives a simple and clear explanation as to why a 30-year mortgage is a better option when refinancing.

We currently seeing amazing mortgage interest rates and those who can refinance, often ask , “What is better a 30 year mortgage or a 15 year mortgage?”. Now, the answer shall always consider your needs and goals, but a 30 -year mortgage brings more benefits rather than a a 15-year mortgage. A recent article by the financial advisor, Ric Edelman, gives a simple and clear explanation as to why a 30-year mortgage is a better option when refinancing.

So, if you haven’t refinanced lately, you should consider it. And when you do, do not be tempted to obtain a 15-year mortgage. Instead, stick with the 30-year loan. Here’s why.

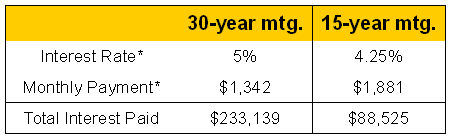

Let’s assume that you are refinancing a $250,000 loan and have two choices, as shown below:

As you can see above, it appears that with the 15-year loan, you are saving $144,614 in interest by paying just $539 more each month!! In reality, the truth is not always so simple. The table above compares the interest you’d pay over 30 years versus the interest you’d pay over 15 years, but in order to make an accurate comparison, we need to see what happens with each loan after the first 15 years.

During the first 15 years of a 30-year loan, you’ll pay a total of $151,280 (or 68% of your payments) in interest. That means 68% of your payment is tax-deductible. With the 15-year loan, only 26% of your payment is interest — meaning much less is tax-deductible. What does that mean for you? Let’s say you are in the 25% tax bracket

15-year later…………………..

Not only does the 15-year loan force you to pay an extra $539 a month, you’ll also spend an extra $116,077 in interest! And if you were to invest that $539 difference at an annual return of 7%,** you’d accumulate $170,843 — enough to pay off the $169,710*** balance that’s left on your 30-year loan after 15 years! When weighing whether to refinance, contact me to help you make the right decision. As the above demonstrates, the best choice is not always obvious!

Follow

Follow