In February 2009, Fannie Mae said it would up the maximum financed-property limit from four to ten to help stabilize the U.S. housing market. “Experienced investors play a key role in the housing recovery”, it said.

This is a truth.

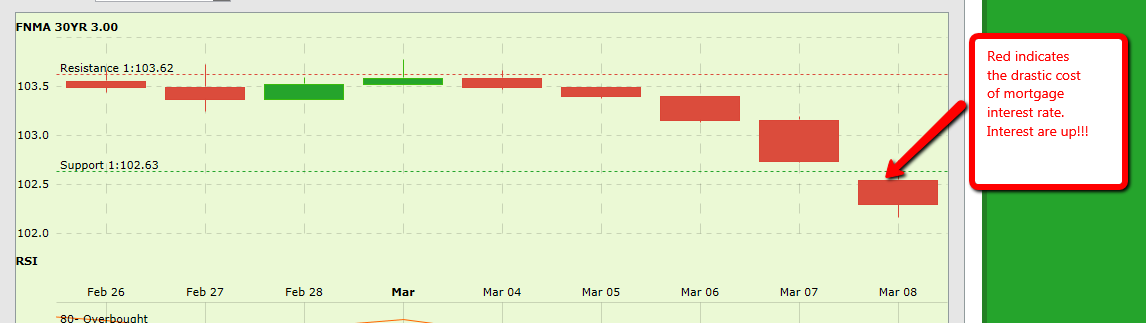

Real estate investors buy foreclosed homes, multi-unit properties, and vacant condos as a means to build wealth long-term. And now, with rents out-gaining the rise in home prices in U.S. cities such as San Francisco, California; Fort Worth, Texas; and Seattle, Washington, investor types are clamoring for good homes — especially with financing so cheap.

15-year mortgage rates with points are below 4 percent.

Why Most Banks Won’t Do A 5-to-10 Properties Mortgage

So, why don’t all banks participate in the 5-10 Properties Financed program? The probable answer is that underwriting a 5-property-owning investor’s mortgage application can be very hard work.

As compared “traditional” homeowners who submit for loan approval with just a W-2 and pay stub, a seasoned real estate investor is asked to provide complex tax returns, complete REO schedules, and extra detail for every home underwritten and approved.

Reviewing paperwork takes time. Sometimes, a lot of it.

Furthermore, investors with 5 or more properties financed are more likely to hold title to their homes in a non-standard fashion. This, too, creates “extra work” underwriting which slows down the approval process for the subject home and for every other loan with the bank, too.

As compared to a standard purchase loan, loans for investors with more than 4 homes financed generates the same bank to the bank but with more man-hours required to approve and additional fraud risk post-closing. It’s no wonder most banks avoid them.

Note : Most banks, not all. You have to know where to find a 5-to-10 Properties loan. Then, you have to meet its guidelines.

The 5-10 Financed Properties Program Criteria

To finance a home via Fannie Mae’s 5-10 Properties program, the following criteria must be met with no exception :

- Own between 5 and 10 residential properties, each with financing attached

- Purchase : 25% down payment is required for 1-unit; 30 percent is required for 2-4 units

- Refinance : 30% equity is required for all property types (1-, 2-, 3-, or 4-unit)

- Minimum credit score must be 720

- There must not be any mortgage lates within the prior 12 months on any mortgage

- There must be no bankruptcies or foreclosures in the prior 7 years

- There must be 2 years of tax returns which rental income from all rental properties

- There must be 6 months of PITI reserves on each of the financed properties

That’s pretty much it. Tough, but not too tough.

Where To Get A 5-10 Properties Program Mortgage

Your bank may not give loans on the 5-10 Properties Program, but don’t let them tell you that it can’t be done. It can.

If you own more than 4 homes with mortgages attached and want to refinance one (or all) of them; or, if you’re planning to purchase an additional investment property, look elsewhere. The 5-10 Properties Program is a niche product but lots of banks will do them

For more information, you can reach me at 951-538-7435

Follow

Follow