When should you close your FHA Streamline Refinance? At the end of the month — no question about it.

When should you close your FHA Streamline Refinance? At the end of the month — no question about it.

Here is a monthly guide with optimal 2013 FHA Streamline Refinance closing dates. Use these closing dates to minimize your “double interest” paid.

The dates below assumes that your home is a primary residence such that the 3-day right of rescission applies.

- March 2013 : A Monday, March 25 closing will fund on March 29, 2013

- April 2013 : A Thursday, April 25 closing will fund April 30, 2013

- May 2013 : A Friday, May 24 closing will fund May 30, 2013

- June 2013 : A Monday, June 24 closing will fund June 28, 2013

- July 2013 : A Friday, July 26 closing will fund July 31, 2013

- August 2013 : A Monday, August 25 closing will fund August 29, 2013

- September 2013 : A Wednesday, September 25 closing will fund September 30, 2013

- October 2013 : A Friday, October 25 closing will fund October 30, 2013

- November 2013 : A Monday, November 25 closing will fund November 29, 2013

- December 2013 : A Thursday, December 26 closing will fund December

FHA Streamline Refinance Mortgage Rates

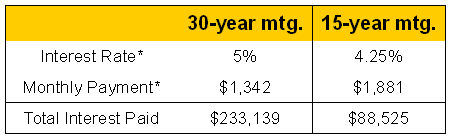

Like most other mortgage rates, FHA mortgage rates have dropped steadily since 2011 and are now near lifetime lows. Refinance activity is up and demand for the FHA Streamline Refinance program remains strong.

If your current mortgage is FHA-insured, see how an FHA Streamline Refinance can help your monthly budget. Qualification hurdles are low, and so are monthly payments. Get started with a presonalize quote now by calling me directly at 951-538-7435

Follow

Follow