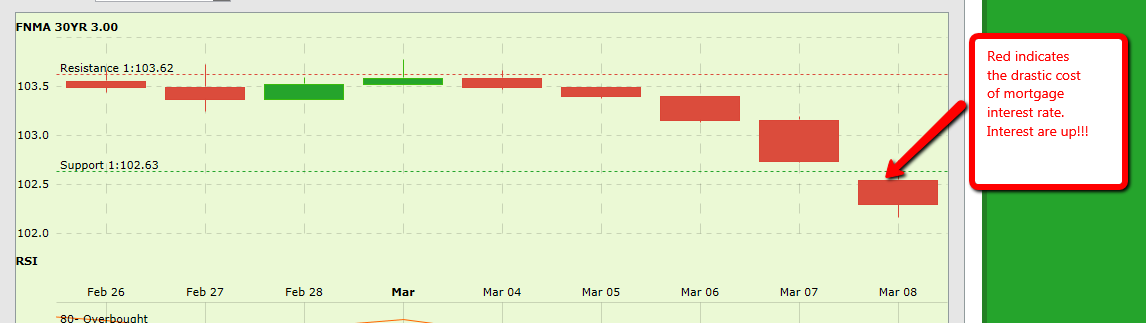

The Chart above provides the performance of the mortgage market in the last 48 hours. Mortgage rates are essentially higher, and the recent unemployment numbers are to blame.

The Chart above provides the performance of the mortgage market in the last 48 hours. Mortgage rates are essentially higher, and the recent unemployment numbers are to blame.

What does unemployment numbers have to do with mortgage rates?

Each month, on the first Friday, the Bureau of Labor Statistics releases its Non-Farm Payrolls report. More commonly called the “jobs reports”, Non-Farm Payrolls details the employment situation of the United States, summarizing by sector. On Friday, March 9th, when the government reported the U.S. jobless rate , the jobless rate dropped to 7.7% in February –the lowest mark in over four years

High unemployment causes a weak economy and a weak economy contributed to low mortgage rates between 2009-2011. In makes sense, then, that mortgage rates should rise when the economy moves to recover.

That’s precisely what’s occurred on Friday.

In the instant that the jobs report was released, mortgage markets sold-off. In other words, investor’s confidence went up. Investors moved their money from bonds to stocks. Within seconds, mortgage bonds tanked enough to raise conforming and FHA mortgage +0.125 percent.

More jobs support economic growth which make investors feel better about risk and investments. Wall Street gets happy! Unfortunately, Mortgage bond markets are the anti-thesis of risk. When Wall Street chases risk, rates tend to rise

Last year’s all-time mortgage rate lows are likely gone for good, lost to an improving U.S. economy. FHA mortgage rates, conforming mortgage rates, and jumbo mortgage rates are all higher today and are expected to remain that way over the long-term, absent explicit market intervention from the Federal Reserve

What to do now?

If you’ve been waiting to lock a mortgage rate or buy a home, take advantage of what the jobs market data is telling you. The economy is improving and, with it, mortgage rates will rise. The rates you lock today may be your lowest rate ever..

Follow

Follow